Debt Reaching a new high

The US debt level recently reached a new high and it currently sits over $28T- this is $3T higher than just a year ago. Coronavirus relief spending was the major catalyst that sent debt higher in 2020. Today, we will analyze what makes up the US debt levels.

US Debt

The national debt is used to measure how much money the US government owes to creditors. The national debt refers to debt levels held by the US government and is commonly measured in one of two ways:

-

Dollars: Total amount owed, measured in trillions of dollars

-

Debt to GDP Ratio: The ratio of a country’s public debt against its total GDP.

To understand this ratio, we need to understand what GDP is.

- Gross Domestic Product (GDP): This is calculated by adding all the money spent by consumers, businesses, and the government within an identified timeframe.

Who Manages National Debt?

The United States Treasury is the executive agency that manages the national debt through the Bureau of Public Debt.

What Does the Treasury Do?

The US Treasury may not directly set financial fiscal policy, but they are directly involved in so much of the nation’s finances. The Treasury is responsible for managing the country's financials and collecting and managing America’s financial instruments. Additionally, the Treasury collects taxes from the Internal Revenue Service (IRS) and funds US debt, by selling Treasury bills, notes, and bonds. The Treasury will auction and issue treasury bonds to investors, to help pay down the national debt.

Explaining Government Bonds

Government bonds, often known as Treasury bonds or simply "T-bonds" are securities issued by the government that have maturities greater than 20 years. They are one of the four types of debt issued by the Treasury to help finance the United States government's spending and planned activities. The other three debts that can be issued include:

- Treasury Notes

- Treasury Bills

- Treasury-Inflation Protected Securities (TIPS)

The main difference between each of these debit-issued securities is their total maturity and payment structure.

Treasury bonds have a fixed interest rate and are paid on a semi-annual basis. These government bonds will accrue interest throughout their entire term. Since they are backed by the government, these are seen as extremely safe forms of investing, much like how a savings account may accrue a very small amount over an extended amount of time. Since these bonds are backed by the U.S. government, they are considered virtually risk-free as the government has several mechanisms to ensure full payments. Most notably, the government can raise taxes to help generate the additional revenue needed to complete all payments. An investor may use T-bonds to ensure a portion of their retirement is completely safe and risk-free. This may also be used to help fund a future expense, like a home or college fund.

What Makes up the National Debt?

There are two major components of the national debt:

Debt owed by the public

-

As we’ve explained, this is the largest portion of the national debt level.

-

This constitutes what the government must be able to pay back to citizens who have purchased government bonds.

Intragovernmental debt

- This portion of the national debt encompasses money the government owes to other government agencies.

- This may include things like social security, or retirement pensions.

Rising Debt Levels

As with any form of debt, the most obvious cause is overspending. When the US government spends more money than it receives, the national debt will increase. Each year the government spends more than it makes, that budget deficit gets added to the national debt.

The government may also increase the debt level through expansionary fiscal policy, which happens when the money supply in the economy increases. This can happen from activities like, increased spending, or even government-issued stimulus checks. Expansionary policy is meant to expand or stimulate the economy.

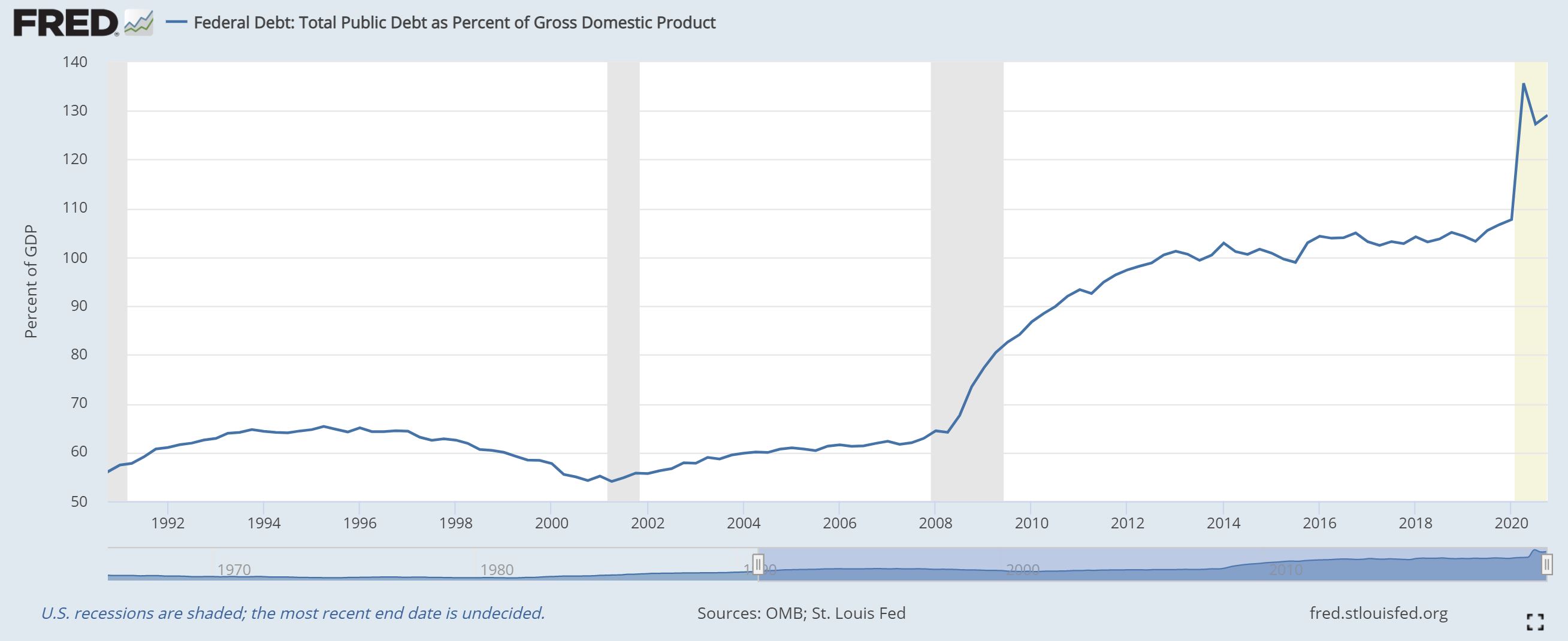

The national debt level has been on an upward trend for decades. Ever since President Regan, (and for any subsequent president), we have only added to our increasing debt levels. Additionally, periods of wartime or recessions have been known to greatly increase the debt as fiscal policy is used to help generate economic growth.

The general public has historically been accepting of the increased national debt if it helps generate economic growth. As an example, if the government issued a large construction contract out to a new vendor, that would generate hundreds of new jobs. This would also help automakers and gas providers as new vehicles will be needed to complete the work. So on, and so on.

Though history has shown, high debt levels will hinder economic growth over time. In fact, countries whose debt to GDP ratio was over 77%, all experienced prolonged economic slowdowns. Studies have shown, higher debt will inherently limit the amount of investments the government can make in capital goods. Thus, also reducing total economic output.

During the Covid-19 pandemic, the government spends trillions of dollars to help contain and battle the virus. Stimulus checks were also issued to help maintain some form of economic growth during the shutdown. Because of this, the debt level is expected to increase by over $3 trillion which would equate to 16% of GDP, the largest percentage since 1945. That increase would more than triple from 2019.

Debt Ceiling

However, there are limits to the amount of government spending that can be done. This is done through a debt ceiling. This number is put in place to limit the amount of debt that can be issued by the Treasury. This number also caps how much the US government may be able to borrow to fulfill obligations.

Future Debt

As we’ve stated, government spending can sometimes be used to help fuel economic growth, even while increasing the debt levels. Economists are predicting that the national deficit level will increase nearly 8% of GDP annually by 2032.

This number could be as high as 12% annually by 2042. A key driver for predicting future debt levels is the assumption that interest rates will eventually rise from their historic lows. The 10-year Treasury note may balloon up to 3% by 2026. As interest rates increase, so will the annual deficit and the GDP ratio.

How to Lower the Debt Level

There are several ways to help lower the national debt, but the most impactful options involve either a cut to government spending or an increase in taxes. Tax hikes can help generate additional revenue for the government. Though, research has shown raising taxes can actually slow down economic growth. Raising taxes means taxpayers have less money to spend, this hurts businesses, which affects jobs and so forth.

With that said, the government tends to favor issuing debt in the form of government bonds. This is another tool the Fed may implore when attempting to raise money. Throughout history, there are examples when a combination of both decreased spending and an increase in taxes did help lower the overall deficit.

Another tool that could be implored involves government bailouts. A bailout is when a business or individual provides money and resources to a failing company or industry. The most recent example of a bailout was in 2020 when the government poured billions of dollars into the Airline industry. Americans weren’t traveling, but the ability to travel anywhere as needed is a core part of America’s infrastructure. Thus, it was determined, a bailout would be issued to provide upfront cash to help airline companies maintain their operations during a time of major uncertainty. Though issuing bailouts opens up several new concerns as you might imagine.

Summary

Keeping America fully operational can be an expensive endeavor! US government spending seems to increase almost annually, and this is especially true during any time of economic uncertainty! The US Treasury is keenly aware of the growing deficit and has several tools it can implore. None of its tools are more impactful than lowering government spending or increasing taxes. Though, they prefer to help lower debt through bonds. It's important investors understand how bonds work, as they can be implored as a different investing strategy to help fund large expenses like tuition.