Qualcomm Inc. (QCOM)

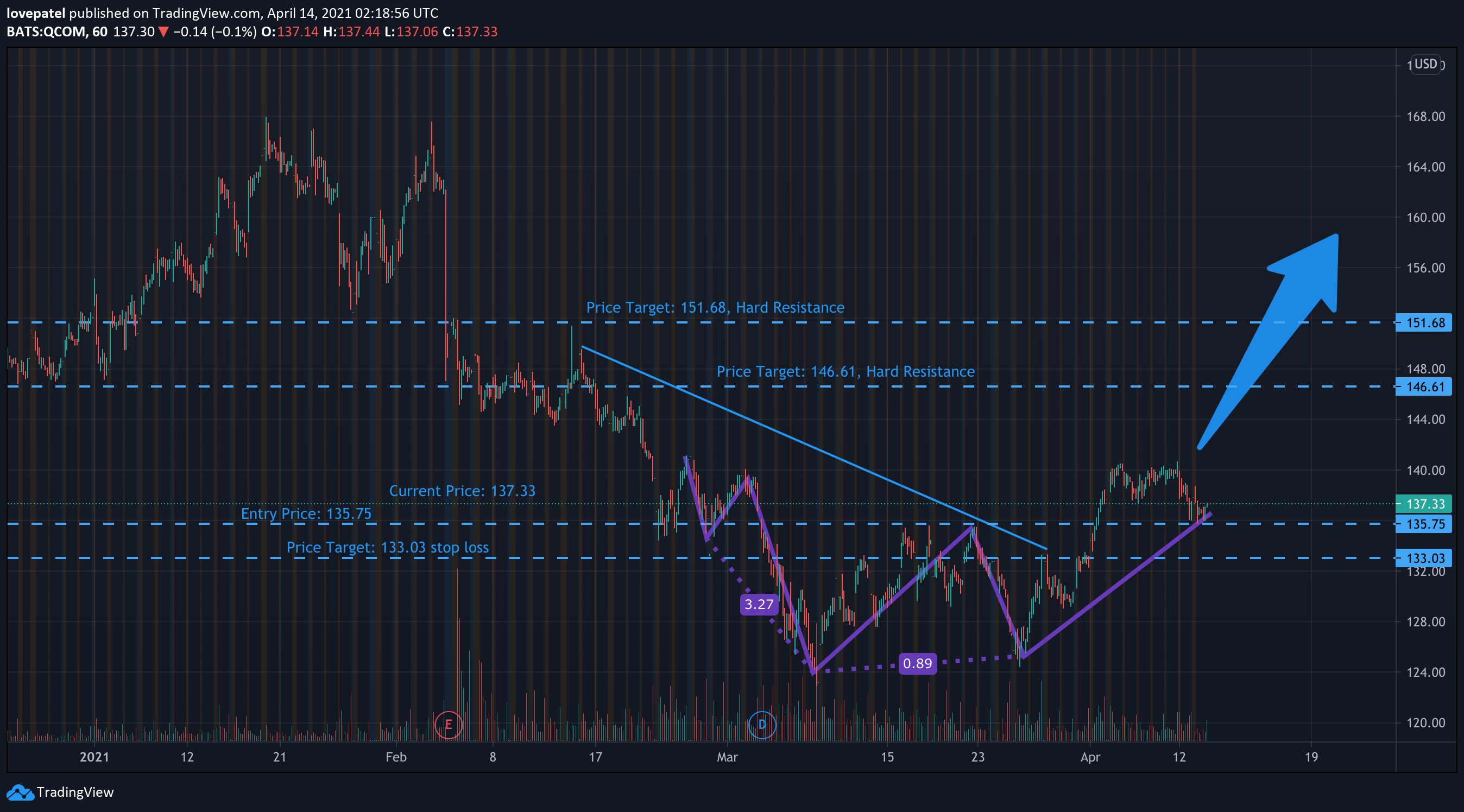

Entry Price/Stop Price/Target Price: 135.75 / 133.03 / 146.61

Time Frame: 4-5 Weeks

Company Description

Qualcomm Incorporated is a global pioneer in broadband applications such as 3G, 4G, and 5G. Qualcomm Incorporated is the parent company of Qualcomm's licensing firm, QTL, as well as the vast majority of the company's patent portfolio. Qualcomm Technologies, Inc., a Qualcomm Incorporated subsidiary, is responsible for substantially all of Qualcomm's manufacturing, research, and growth operations, as well as substantially all the company's products and services divisions, including its semiconductor division, QCT.

Thesis

Qualcomm (QCOM) paid $1.4 billion for NUVIA at the beginning of this year. Now with the acquisition delivering major increases in performance and energy consumption for 5G computing, we're starting to see price appreciation. Additionally, policy has an important part to play in the recent growth of QCOM after President Biden initiated a $2.3 billion capital package for the space.

Technical Analysis

As of 04/12, QCOM has begun to find new support, emerge from an inverted head and shoulder trend, and regain market momentum. The new support is being formed at 135, and the 100-Day MA has passed over the 150-day MA (golden cross) reinforcing that the bullish trend we've seen is continuing. Our profit margin of 8% is below the three-month ATH, which is reachable if the momentum persists, and with good reports from the White House on the funding bill on the way, the stock is expected to continue to rise to new highs. We're seeing signs of turnaround right now, and if they persist, now will be a perfect time to get a spot in the market.