Taiwan Semiconductor Manufacturer Co (TSM)

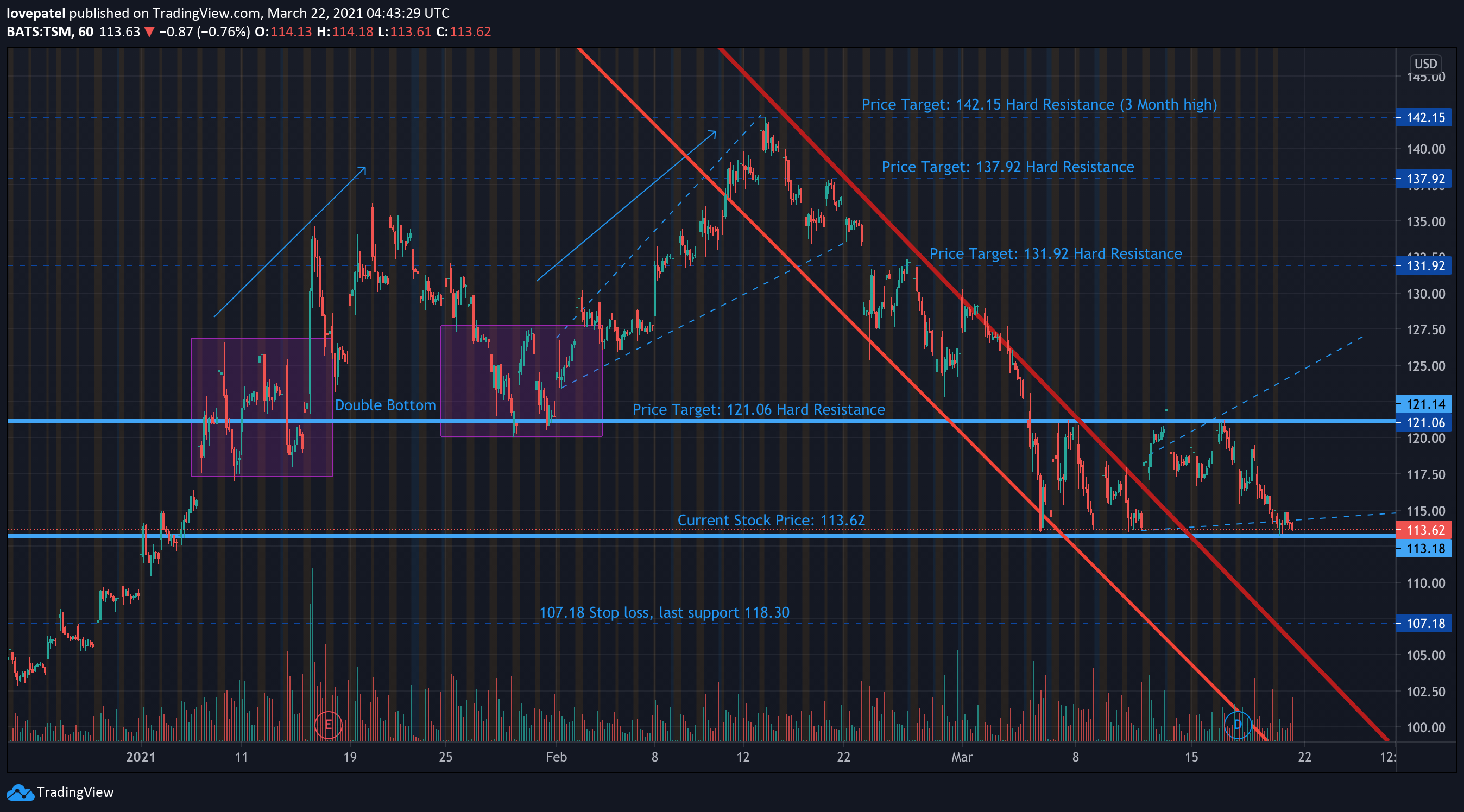

Entry Price\Stop\Target: 113.63/ 107.18/ 131.92

Time Frame: 3-4 weeks.

Description

Taiwan Semiconductor Manufacturer Co (TSM) is the world's largest dedicated integrated circuit foundry. As a foundry, the company manufactures integrated compound semiconductors (ICs) for its customers based on their proprietary IC designs using its advanced production processes. TSM's goal is to establish itself as one of the world's leading semiconductor companies by building upon the efficiencies that have made it the leading IC foundry in the world.

Thesis

TSM is the sole supplier of about 75% of the semiconductors in the world with nearly a monopolized business. A recent analysis report from a JP Morgan analyst suggested that there is a massive shortage of semiconductors in the USA. Fortunately, President Biden is signing a bill that aims to reduce this shortage through subsidies and incentives totaling up to $35 billion. This aid will act as a catalyst for TSM. Insider trading has remained low which boosts confidence in the leaderships’ beliefs in the company.

Technical Analysis

Currently we see this trading in a channel of prices between 113.21-121.06. I am seeing two possibilities; the stock breaking the trend and going below its channel range or go up. Regardless, I believe this is a good, discounted price to get a position. TSM has a mix of two patterns; a double bottom which is followed by an uptrend for about 12 average trading days. This pattern has been noticed more than twice over the last month. The RSI is currently at 54.92 indicating a neutral bought and sold market for the stock. The MACD crossed over at 03/19 market close giving us a bearish signal. But the current distance between the lines is reducing and expecting to see a cross-over to a bearish signal.